The world quietly snuck past an important milestone recently. More than half of the global population now uses the internet, though the exact number is disputed. The World Bank estimates global connectivity at around 56%, while industry expert GSMA reports a more conservative figure of 51%.

Either way, the trend is clear. From only a few million in the early 90s, the number of internet users has exploded to connect billions and transformed the way we live our lives. However, one segment of society lags behind: rural internet users.

This article will explore the current and future state of rural internet (and how it’s being driven by mobile internet penetration) and the implications for e-commerce businesses looking to expand.

- What is the current state of global rural internet?

- The last mile: the problem with high-speed rural internet

- How does mobile internet penetration offer a solution?

- Where is mobile internet penetration today?

- How will rural internet access impact e-commerce?

What is the current state of global rural internet?

Internet access is characterised by connectivity (do people have internet access?) and quality (how reliable is this connection in the modern day?). We provide an outline of both for consumers across the globe below.

Rural internet connectivity

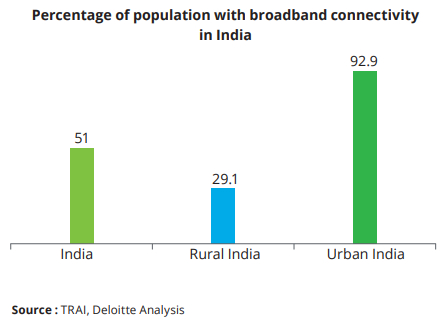

The problem with internet connectivity can be summarised in the following image:

Image from Deloitte: Broadband for inclusive Development, 2020

While internet access is increasing across the globe, it’s fraught with geographical disparities. Urban areas enjoy the most access to high-speed broadband, leaving rural communities behind. This pattern is repeated, although not quite as harshly, in other parts of the world.

For example, data from the ITU, the UN’s agency for developing global connectivity, shows that internet access is highest on average in Europe, with around 88% of urban areas connected to broadband. However, only 78% are connected in rural areas across Europe. In contrast, over 70% of urban areas in Arabic, Asian and Pacific nations are connected on average, but connectivity in rural areas dips to less than 40% on average across each.

Rural internet quality

Of those that are connected, what is the quality of their internet?

Internet speeds are vastly different across the globe, but streaming (downloading video content, live or otherwise) is typically used as a reference point for quick comparison between regions.

For example, UK rural internet users can expect broadband speeds of around 50 Mbits/s, 40% lower than urban areas but still enough for household streaming. In contrast, better-connected urban consumers in Indonesia and the Philippines may only receive broadband connections of 20-30 Mbits/s. Unfortunately, these speeds may struggle to support a family of internet users.

Therefore, even if rural internet users in these communities have broadband, they often get by on very little bandwidth. As a result, many opt for wireless networks, using 2G or 3G connections instead, which struggle to cope with modern demands, like streaming services.

The last mile: the problem with high-speed rural internet

What’s causing these disparities in connectivity and quality in rural internet?

Broadband infrastructure is reliable but expensive. The slowest ADSL connections require an existing phone line network to piggyback off of and modern cable and fibre installations involve laying new connections to upgrade speeds.

Therefore, broadband connectivity typically emerges in densely populated and wealthier areas first, which are almost exclusively urban ones. Poorer urban areas can afford broadband access as they have the collective purchasing power that prospective rural internet users lack.

How does mobile internet penetration offer a solution?

Mobile internet penetration, on the other hand, is relatively cheaper but can be less powerful.

Cell towers can be built in one area and reach customers for miles around, to achieve connectivity. However, mobile internet penetration comes with drawbacks, thanks to geography once again. High bandwidth connections use higher frequencies, allowing things like streaming but at the cost of range.

For example, 5G, the cutting edge of today’s mobile internet technology, offers less than 2% of 4G’s range. As a result, dispersed rural internet users often sacrifice speeds for more stable connections.

Where is mobile internet penetration today?

Fortunately, the range-bandwidth dilemma is only seen at the extremes of internet infrastructure. 3G and 4G technologies are the latest mass-adopted mobile internet technologies. Although they can’t offer the speed and bandwidth of 5G, each is suitable for personal usage demands like streaming.

Today, the global coverage gap (people who lack any internet infrastructure) stands at only 6%. Of this 94% covered, 85% can access 4G speeds, increasing to 89% for 3G speeds (the lowest mobile technology capable of streaming meaningfully).

The limitations of mobile internet penetration

With only 6% of the world’s population left without any form of internet access thanks to wireless technologies, what’s holding back rural internet users’ mobile internet adoption?

GSMA’s The State of Mobile Internet Connectivity 2021 report identifies several reasons. . Some factors GSMA identified are understandable, like digital literacy or pricing. For example, phones, tablets and computers are still expensive in many regions, so some consumers just can’t afford or don’t understand how to get online.

Other factors are more surprising. For example, in some nations, citizens simply aren’t aware that wireless technologies cover their area. Unlike broadband’s conspicuous wired infrastructure, a single 3G cell tower can be erected up to 45 miles away, and consumers may receive coverage without even realising.

Open a World Account for free

- Open up to 15 local currency accounts, with local sort codes, account numbers and IBANs

- Collect secure payments from 130+ marketplaces, overseas buyers and payment processing gateways

- Pay suppliers, partners and staff in 40 currencies without hidden fees

- Pay and get paid easily with local bank details on your invoices

- Lock in conversion rates to manage your currency risk

How will rural internet access impact e-commerce?

So far, we’ve seen that mobile internet penetration is the driving force for rural internet users, but what bearing does this have on their spending habits?

Internet connectivity is correlated with economic growth, so we can expect consumer spending to grow with the number of active rural internet users. Equally, computerised services and online platforms help reduce overheads and improve efficiency (a model only entrenched by COVID), so the push for internet access will also come from the public sector.

As a result, rural consumers either getting access to the internet for the first time, or improving their existing access, will stumble across the global e-commerce ecosystem awaiting them. And the relationship could prove fruitful.

Decreasing manufacturing costs and clever software design means that technology is becoming more accessible. Devices are easier to acquire and digital literacy is easier to build. From a demographic viewpoint, internet usage is highest among young people. As a result, rural usage rates will keep pace with this cohort as they become more economically active and assume an internet-first approach. Similarly, the internet’s closing gender gap means consumer spending will see increases in categories popular with women.

Popular product categories within rural internet markets

Every e-commerce business wants to know what the next big ‘it’ category is. After all, being first to market is often just as important as being the best. We thought we’d take research from the Chinese e-commerce market for what the future of rural e-commerce might look like elsewhere.

China is an excellent model to use for several reasons. Firstly, China has a large proportion of rural internet users: between 70% and 80% of China’s total population is online. Secondly, China’s low car ownership, especially in rural areas, makes convenience a focus for consumers. Thirdly,

China’s middle class (some, though not all, being rural) is growing rapidly.

As mobile internet penetration increases and rural communities develop across the globe, e-commerce will continue to present the perfect stop-gap: offering convenient delivery of a vast range of goods, all at low prices.

Research on China’s e-commerce market from Goldman Sachs ranked six product categories by consumer priority:

- Clothing and personal care

- Food and drink

- Homeware and decor

- Personal devices and travel

- Fun experiences

- Health and wellbeing

At present, goods from the first two categories represent nearly half of consumers’ spending in China. Customers are initially keen to splurge on their appearance and home setting, buying goods like clothing, cosmetics, jewellery, fresh food, alcohol, and homeware items like decor and appliances.

However, the fifth and sixth categories (fun and health) hold the most growth potential. Over time, consumer priorities evolve to favour experiences like being healthy and happy more heavily. As a result, consumers swap the enrichment they once got from domestic items like clothes and food to media, games, and wellbeing.

If you’re looking to capitalise on the rising number of rural internet consumers, tracking these purchasing trends will be key. Conduct lots of market research to ensure you’re always at the front of shifting consumer needs and build a flexible business model to allow you to pivot when needed.

Shared problems: rural internet and rural e-commerce

We already touched on the ‘last mile’ problem of rural internet connectivity, namely, the problem in connecting individuals at the very last stage. Unfortunately, the same problem is repeated in e-commerce, this time as the last mile of customer delivery.

Like internet connectivity, the last mile of package delivery to rural communities is made all the more difficult because of their dispersed living arrangements. At their most extreme, communities can be tens or even hundreds of miles apart, making delivery efforts expensive for both parties.

E-commerce businesses will need to implement delivery models that take advantage of fulfilment relationships and innovative logistics approaches to build successful relationships with rural internet users at the price point they need.

Finally, as mobile internet penetration takes precedence, e-commerce businesses should prioritise efforts to optimise mobile/web apps and low-bandwidth access for the best customer experience.

Businesses like yours trust WorldFirst

- Almost 1,000,000 businesses have sent $150B around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions

What our customers say about our services