Pay Chinese Suppliers - Fast

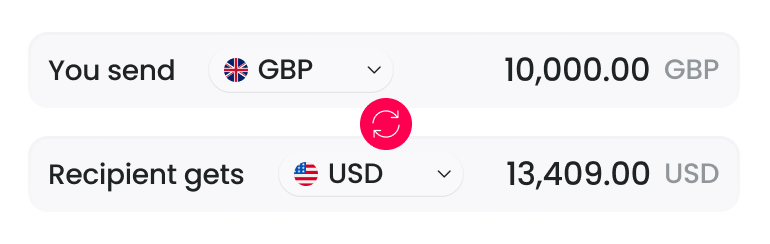

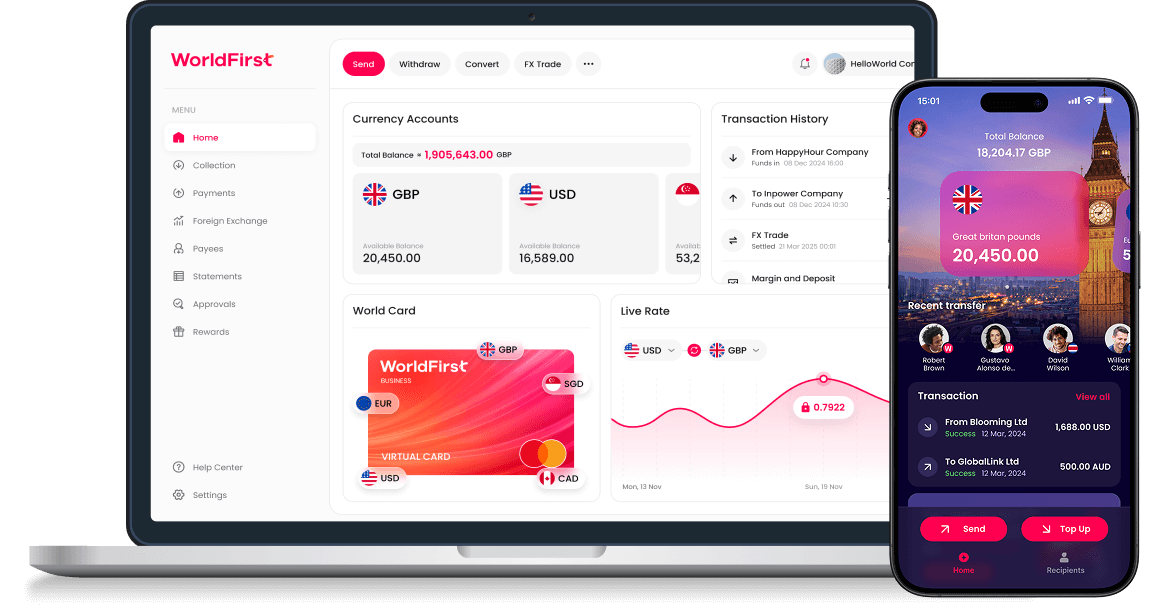

Transfer money to China from the UK with same-day USD payments.

Zero hassle. Total confidence.

When it comes to sending money to China, we're the experts

From direct payment routes with China’s top banks to skipping delays, nobody moves money from the UK to China like we do. That’s how you can stay ahead with same-day transfers* when others can’t.

Plus, 150,000+ Chinese suppliers are already on WorldFirst, making transfers from your account to theirs instant, free, and seamless.

And with 30+ global offices, we can support you wherever you do business.

*Subject to payment cut-off time and beneficiary bank.

WorldFirst vs. others

Why choose WorldFirst?

Pay China, and beyond

FAQs

A payment cut-off time is the daily deadline your payment needs to hit to be processed today. Send money before the cut-off and it moves the same business day. Miss it, and it rolls to the next one.

MYbank is available for processing payments between 9:30-15:00 China Standard Time. To be processed via this route, payment requests need to have been submitted by 7:00 local time.

MYbank is available for processing payments between 9:30-15:00 China Standard Time. To be processed via this route, payment requests need to have been submitted before the close of this window. (Daylight saving hours – by 7:00)

It’s the bank on the receiving end of your payment. Your money lands there first, and they credit it to the person or business you’re paying.

With WorldFirst, most payments to China move fast. USD and CNH transfers can arrive the same day, as long as you pay before bank cut-off times so the funds have time to clear.

Transfers between WorldFirst accounts land instantly, and around 90% of payments to China clear on the same day*.

We are able to do this because of our sister company MYbank, a regulated bank in China. Being connected with a local bank enables us to move funds internally and via (faster) local payment rails instead of SWIFT.

Where the cutoff time is missed, payments will be transmitted via SWIFT, which can take 3 business days.

Finding the right supplier in China can open up new margins, new products, and serious room for growth. The good news? You’ve got options — and support.

A few ways to get started:

- Tap into WorldFirst’s China network

We have teams on the ground across China and deep local connections. More than 150,000 Chinese suppliers already use WorldFirst, which means payments between your accounts are instant and free. - Use trusted marketplaces

Platforms like 1688.com are a great place to browse, compare, and vet suppliers. You can even pay them directly from your World Account balance in USD or CNH. - Leverage our global ecosystem

With 1.5m+ businesses using WorldFirst worldwide, we’re plugged into supplier networks across multiple industries and regions — and we’re happy to point you in the right direction.

RMB is the name of China’s currency: it stands for Renminbi. CNY and CNH are two versions of it.

- CNY is the onshore currency, traded and regulated within mainland China.

- CNH is the offshore version, traded internationally with fewer restrictions.

Think of it this way: RMB is the currency family, CNY lives onshore, CNH lives offshore.

While there isn’t a fixed order limit for purchases from businesses in China, there are risk-based controls on money flowing in and out of the region, particularly for larger orders. This takes place in the form of additional checks on the seller’s side, so would be handled by them.

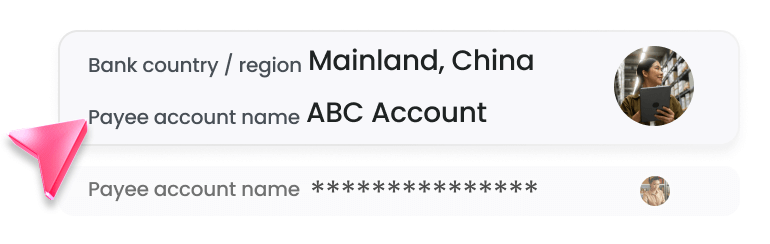

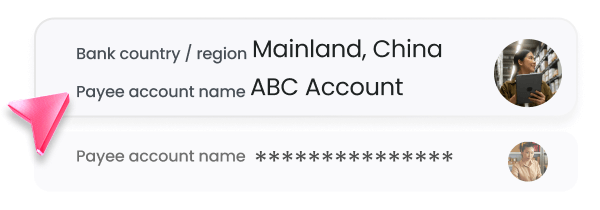

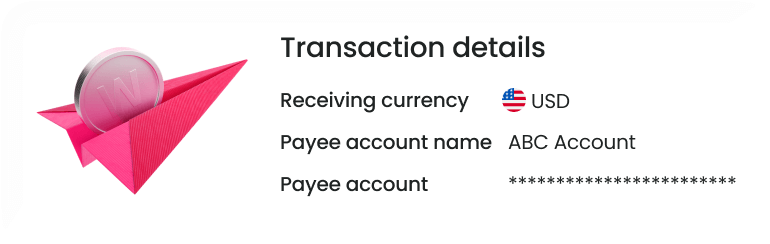

Once you’ve agreed a purchase, you just need to submit the payment request. If you are sending to someone for the first time, you will need their Account Name, SWIFT/BIC ID and Account Number to hand. If the seller also has a World Account, it’s even easier – just ask for their WorldFirst Payment Account number (it begins with WF-).

The WorldFirst Payment Account number can be found in ‘Your details’ section: https://portal.worldfirst.com/setting/business.